As the downstream fuel industry enters 2025, operators are focused on enhancing customer experience, boosting profitability, and improving operational efficiency—all while maintaining the agility needed to navigate an unpredictable market. With U.S. fuel consumption expected to level off in 2025 before declining in 2026 (EIA), retailers can no longer rely on growing demand to drive profits. Instead, they must optimise costs and streamline operations to remain competitive.

These insights emerge from the Titan Cloud 2025 Downstream Fuel Report, developed in collaboration with NACS Research. The survey captures the perspectives of enterprise and mid-market fuel retailers, identifying the trends and challenges shaping the sector’s future. By understanding the key factors influencing industry decisions, fuel retailers can position themselves for sustained success.

Customer Fueling Experience

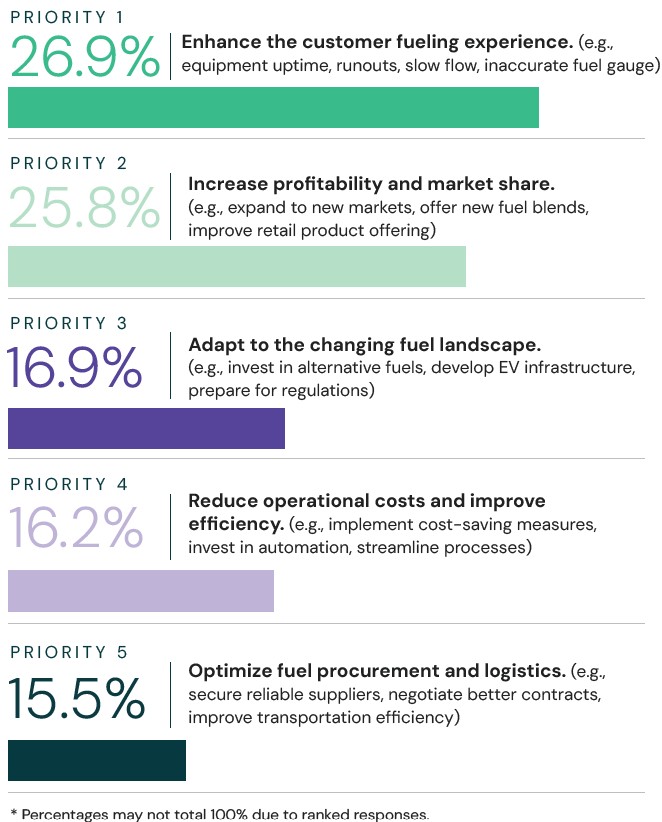

Fuel retailers recognize that a seamless customer experience is a competitive advantage. Over half of respondents acknowledged it as a challenge, with 26.9% naming it their top priority. With increasing expectations for speed, convenience, and reliability, operators are looking for ways to differentiate their forecourt and in-store offerings—all while balancing cost optimization in a market where demand alone is no longer a growth driver.

Top 3 Strategic Priorities in the Next 3 to 5 Years

A focus on improved forecourt maintenance and real-time monitoring is emerging as a strategy to prevent equipment failures that frustrate customers. Additionally, frictionless payment solutions and enhanced loyalty programs are being implemented to drive engagement.

“Slow flow is a common frustration, and we know flow rate decreases over time without proper filter maintenance,” says Brent Puzak, Senior Solutions Consultant at Titan Cloud. “Real-time monitoring helps operators pinpoint exactly when and where maintenance is needed.”

Profitability and Market Growth

Profitability remains a priority, with 25.8% of respondents citing it as their main focus. While enterprise retailers lean on innovation (63.3%), mid-market operators tend to prioritize cost control and efficiency (58%). However, fuel price volatility continues to impact profit margins, forcing retailers to adopt more dynamic pricing models and real-time analytics.

Technology plays a significant role in achieving profitability goals, with data-driven decision-making allowing businesses to forecast demand, manage inventory more effectively, and identify areas for cost reduction.

Across both segments, profitability faces headwinds from rising operational costs and market volatility, requiring careful planning and investment in operational resilience. In response, companies of all sizes must balance short-term cost controls with long-term investments in innovation to secure sustainable profitability.

Adapting to the Changing Fuel Landscape

With nearly half of respondents ranking agility among their key priorities, enterprise retailers are turning to automation and analytics for real-time decision-making. Mid-market operators are using technology primarily for discrepancy tracking and fuel loss prevention.

Parker’s Kitchen, a Titan Cloud customer with over 90 locations, leverages fuel analytics for long-term success.

“We have the tools we need to make data-driven decisions, enhance supply chain efficiency, maintain compliance and reduce costs,” said Ricky John, Vice President of Fuel at Parker’s Kitchen. “As we expand our footprint, we’re setting ourselves up for long-term success and ensuring that we can meet the demands of our growing network.”

Supply chain unpredictability remains a major concern, and operators are finding that agility is now a necessity. With global disruptions affecting fuel availability and pricing, retailers are re-evaluating their supply partnerships and integrating logistics solutions to ensure continuous operations.

Reducing Operational Costs and Improving Efficiency

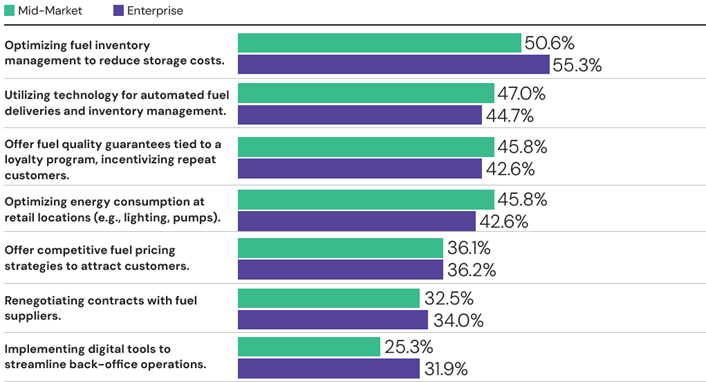

Among respondents, 28.8% named rising operational costs a top challenge. The survey data, however, revealed priorities and interesting distinctions between mid-market and enterprise respondents. For example, fuel inventory optimization was universally the most used strategy for addressing rising costs, including reducing storage costs, improving inventory efficiency, and mitigating fuel loss. While 55.3% of enterprise organizations said they rely on such optimization, slightly fewer mid-market organizations agreed (50.6%).

Strategies for Combating Rising Operational Fuel Costs

Automated solutions were slightly favored by mid-market retailers, with 47% naming technology adoption as key to automating fuel deliveries and inventory management. Enterprise organizations were slightly less automation focused at 44.7%. These results are in line with similar industry reports.

Even with those employing technology, however, a significant gap remains in technology adoption and access to real-time data, including actionable fuel loss root cause insights. These key fuel analytics enable automated investigations, minimizing manual follow-up and reducing operational delays.

Fuel Procurement and Logistics

While procurement optimization ranked lower in priority, with about a third of respondents acknowledging it as a major challenge. Cost efficiency and fuel availability remain top concerns, with 53.6% focused on price and with 28.6% prioritizing uninterrupted access.

Order of Importance Making Fuel Purchases

Additionally, more than 60% of both mid-market and enterprise retailers rely on outsourcing for fuel logistics. However, Paul Lauinger, Titan Cloud’s VP of Sales North America, warns that outsourcing isn’t always the best solution.

“Vendor outsourcing can seem like an easy go-to for midmarket operators, but investment in the right in-house technology, particularly a unified platform, provides a strategic advantage,” says Paul Lauinger, VP Sales North America, Titan Cloud. “One of our customers, a 50-store convenience chain, implemented technology automation as part of an aggressive, acquisition-based growth strategy across three states. They now have the centralized hub, end-to-end visibility, and data insights needed to grow effectively.”

Fuel procurement strategies are dominated by two pillars: cost control and consistent supply. While technology adoption is growing to optimize both, it remains underutilized, representing an opportunity area for enterprise and mid-market operators to drive growth.

The Future of Fuel Retail

The 2025 Titan Cloud and NACS Research report highlights how fuel retailers are striving to optimize operations while preparing for market shifts. Technology-driven solutions, including automation and real-time data analytics, will be critical in enhancing efficiency and driving growth in an evolving landscape.

As the industry continues to evolve, fuel retailers must take decisive action to remain competitive. Get more details on the Downstream Industry Fuel Report for in-depth data and strategies that fuel retailers are using to improve efficiency, profitability, and operational resilience in 2025.